Free Velocity

Banking Workbook

Made With Google Sheets

Income

Any funds that you consider income. If you have varying income, include the avg/mo

Expenses

This is for lifestyle and living expenses only. Items that generate a balance per month.

Assets

House, Investments, Stocks, Retirement Accounts, Etc.

Debts

Your car belongs here, along with credit cards, Loans, and Lines of Credit.

Watch Our

Free Training

This is a walk through of the sheets so you can get a feel for where things go. As always, feel free to reach out to address any questions. We love feedback!

Many Things We Can't Control In Life,

But This, We Can Do!

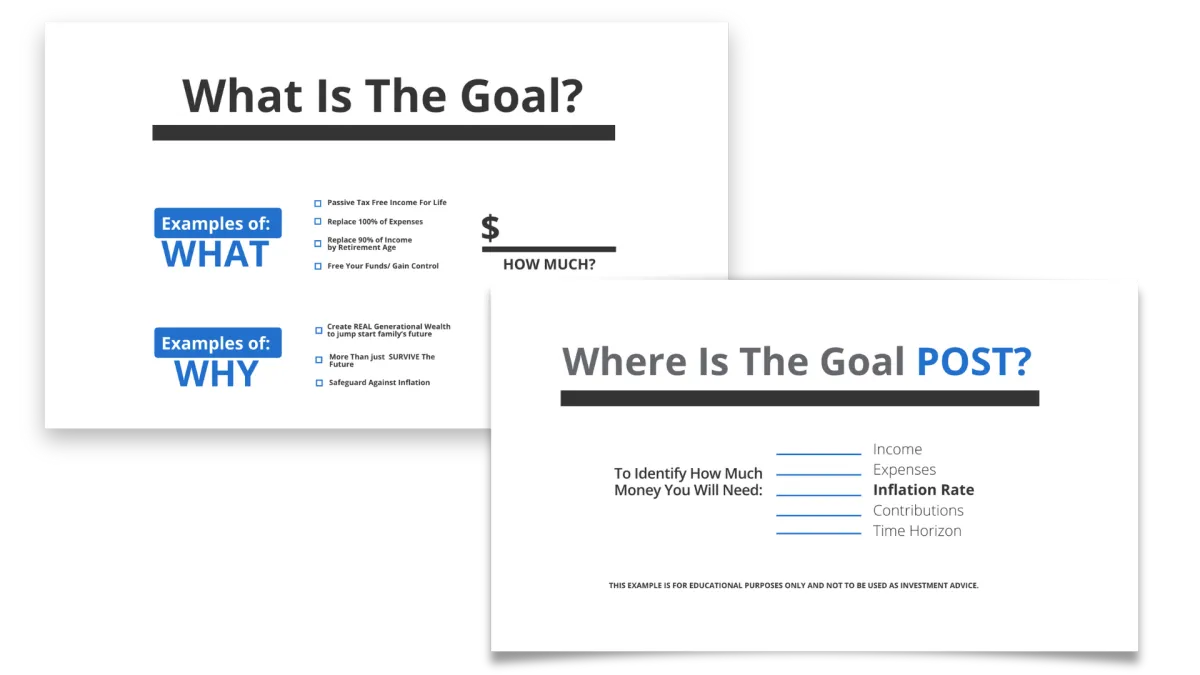

"If you don't know where you're going, any road will take you there." We say that all of the time because it's true. We need to understand exactly what we need in order to understand how to allocate our resources and most importantly, our time. There are many ways to TEN. Being debt free doesn't have to mean that you are also income-free. What's the plan and who's involved?

More 101 Videos That May Help

Transformed our financial situation

I found out a lot of information. After I did that, the YouTube algorithm brought you and your wife. And I thought you all were friends. It was really nice. It made me feel really good to know that a couple is working together. My husband, he doesn’t usually give compliments, but he said, ‘That man knows what he’s talking about.’ You made a believer out of him.

I was skeptical at first, but after applying your strategies, my husband and I have seen significant improvements in our financial health. Your guidance on debt management and investment has been invaluable.”

Natalie C

" The way you broke down the information for us made everything so clear. I appreciate the patience and detail you put into explaining everything."

-Natalie's Son, Josiah

I can see a brighter future ahead.

Your insights on velocity banking have been a game-changer for me. By applying your methods, I’ve been able to reduce my debt and improve my cash flow significantly.

I’ve been watching you for a couple of months now. I really appreciate the clarity and honesty in your advice. You have a knack for breaking down complex information into easy-to-understand steps. It’s refreshing to have someone explain things like I’m five years old, so I know exactly what I’m getting into.

It’s reassuring to have someone as knowledgeable as you guiding me through my financial journey.

Your approach to financial planning is refreshing and effective. I now have a clearer path to financial stability and growth.. "

- Pat L

Tailored To My Needs

... was practical and tailored to my needs. I can already see positive changes in my financial situation. I appreciate your honest and straightforward approach. It made all the difference in understanding my financial options. The personalized strategies you provided have set me on a path to financial stability and growth.”

Jessica H

Complex topics into easy-to-understand steps

The consultation was extremely helpful. I feel more informed about my options and confident in my financial decisions. Thank you for your patience and for breaking down complex topics into easy-to-understand steps. I left the session with a clear action plan and a sense of empowerment about managing my finances.”

-David M

Now I have a clear plan

The guidance I received was straightforward and actionable. I now have a clear plan to pay off my debt faster. I appreciate the detailed explanations and the time taken to understand my unique situation. Your expertise has given me the confidence to take control of my finances and build a secure future. "

Sarah K

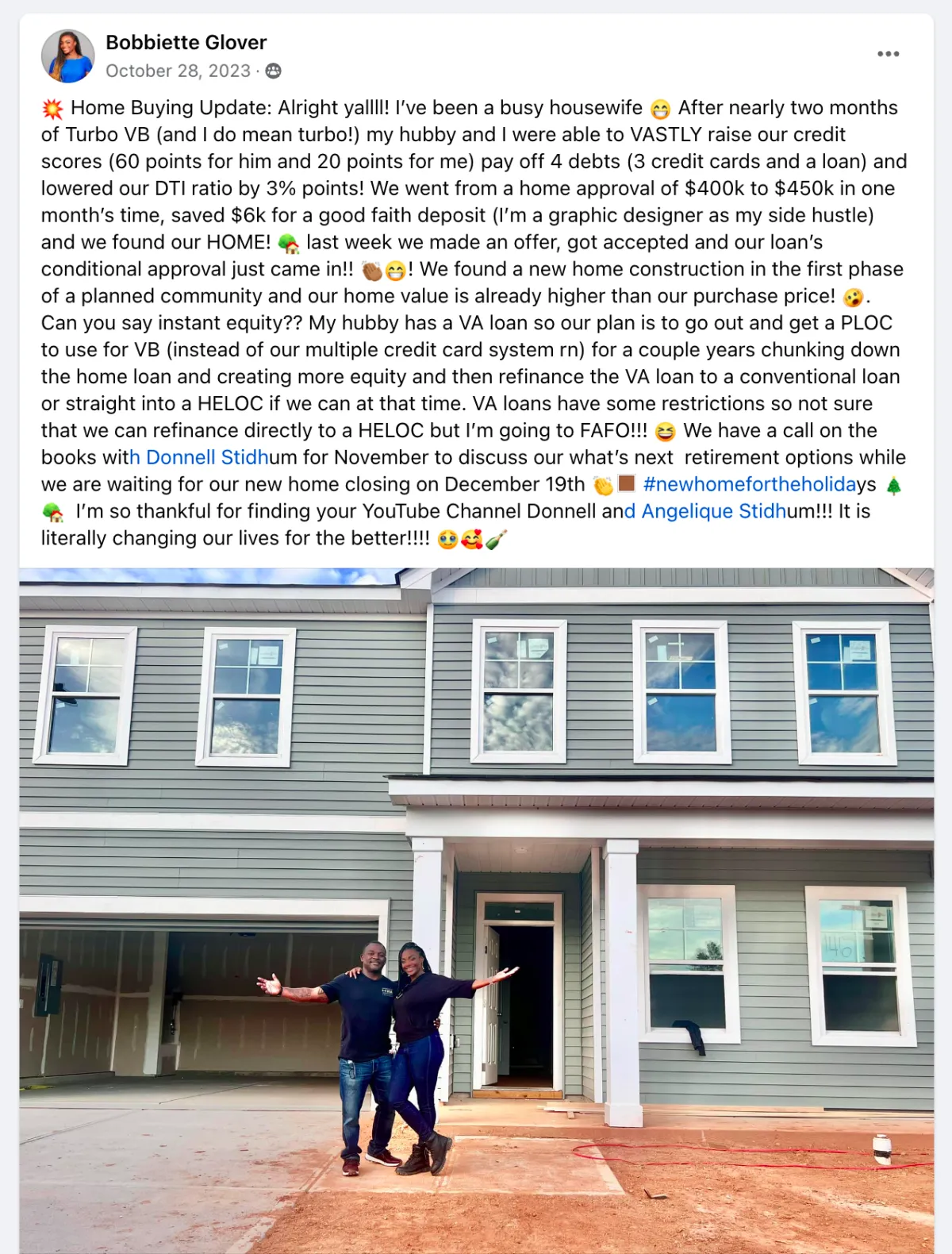

Watching your videos and following your advice has transformed our financial situation

The practical advice and clear explanations provided during the consultation were invaluable. I feel empowered and equipped with the right tools to take control of my financial future. Your approach is both professional and personable, making it easy to understand and apply the strategies discussed. "

Robert L

Transformed our financial situation

The session gave me a fresh perspective on managing my finances and leveraging my income more effectively. I value the practical advice and the realistic approach you provided. It has truly made a difference. Thanks to your guidance, I now have a solid plan to pay off my debt and start building wealth. Your expertise & ability to explain complex concepts in simple terms have been incredibly helpful. I feel more confident in my financial decisions and future planning after our discussion."

William S

I can see a brighter future ahead.

The session was incredibly informative and helped me understand complex financial concepts with ease. Thank you for breaking down the steps so clearly. I feel much more confident about managing my finances now.

Your advice has been transformative for my financial planning. I can see a brighter future ahead "

-Emily T

What If Learning This Concept Was Simplified?

The concept of utilizing leverage at at the root of many of the strategies we've personally used in our own financial profile. That's why we are so passionate about teaching others how to identify where leverage is and the impact information will have on the opportunities you can identify... or pass by.

FAQ'S

What is Velocity Banking and how does it work?

Velocity Banking is a financial strategy that involves using a line of credit, such as a HELOC, to manage cash flow and pay off debts faster. It leverages your income to make multiple payments towards debts each month, reducing interest and accelerating debt payoff.

What should I do if my credit is impacted by multiple inquiries?

If your credit has been impacted by multiple inquiries, you can dispute those inquiries, especially if you did not receive any value from them. Consolidating inquiries related to the same purpose can also help mitigate the impact on your credit score.

What is the best strategy to manage negative cash flow until my cash inflow starts?

Focus on minimizing expenses and possibly using a debt snowball method to pay off smaller debts first. This can help free up some cash flow and make it easier to manage until the larger cash inflow begins.

How can I improve my cash flow while paying off debt?

You can improve your cash flow by reducing expenses, using a debt snowball method to pay off smaller debts first, and leveraging any lump sum payments or additional income to pay down high-interest debts.

How do I choose between different debt repayment strategies?

Choosing between debt repayment strategies depends on your financial situation. If you have positive cash flow, velocity banking might be effective. If you have negative cash flow, the debt snowball method, which focuses on paying off smaller debts first, may be more suitable.

What is the difference between debt snowball and velocity banking?

Debt snowball involves paying off smaller debts first to build momentum and free up cash flow. Velocity Banking uses a line of credit to pay down larger debts faster by making multiple payments each month. The best method depends on your cash flow situation.