Not Sure Where To Start?

Velocity Banking 101

This strategy is SURE help you:

Crush Debt

Reduce Interest

Increase Your Leverage

Income

Incoming Funds That Are Considered Income.

Bank

The Bank Acct You Typically Use To Deposit Your Income.

Debt Tool

A Line Of Credit With The Most Room & Best Terms.

Expenses

Funds Used To Make Payments You Make Each Month.

Cash Flow

Money Left Over After All Bills Are Paid.

Struggling To Get Your Spouse On Board?

You're Not Alone.

Start Here:

What Is The Goal Of Implementing

Velocity Banking?

It's a Financial Strategy designed to accelerate debt repayment by leveraging a Debt Tool and effective Cash Flow management.

The primary goal is to allow the cashflow to sit on the debt tool instead of in a checking acct. This reduces allows the cashflow to work FOR you, while still available in the event that you need to use it. This reduces the overall interest paid and shortens the debt repayment period.

Faster debt payoff

Sig. interest savings

Increased cash flow

Strengthen Credit

Multiple Use of Dollar

Two Key Pieces To This Strategy:

Debt Tool

A Debt Tool Is A Line Of Credit That The Ending Cash Flow Balance Will Reside On, Thus, Reducing The Balance & Overall Interest Paid.

Examples: HELOCs, Personal Line Of Credit, Credit Cards

In order for a line of credit to qualify as a debt tool, it must meet the following:

Money Must Flow In & Out

Not A Loan

Lowest Interest Rate

Has Room To Absorb Other Debt

Cash Flow

Cash Flow Is The Money That's Left Over After All Payments Are Made Toward Assets and Expenses.

Note: Most People Aren't Aware Of Their True Cash Flow Number.

In order for cash flow to be effective in this strategy it must:

Be A Decent Amount

Reside On The Debt Tool

Not Sit In Bank Acct

Not Be Spread Across Debts

Get Started!

Gather Your Numbers

This Google Sheets Workbook is designed to help you collect, categorize, and assess.

Watch These Case Studies Of People Just Like You:

(These are actual viewers who booked a FREE consult. Their names have been changed for privacy)

We helped him create a step by step plan to crush

$22,4oo of CC debt in 15.5 mos

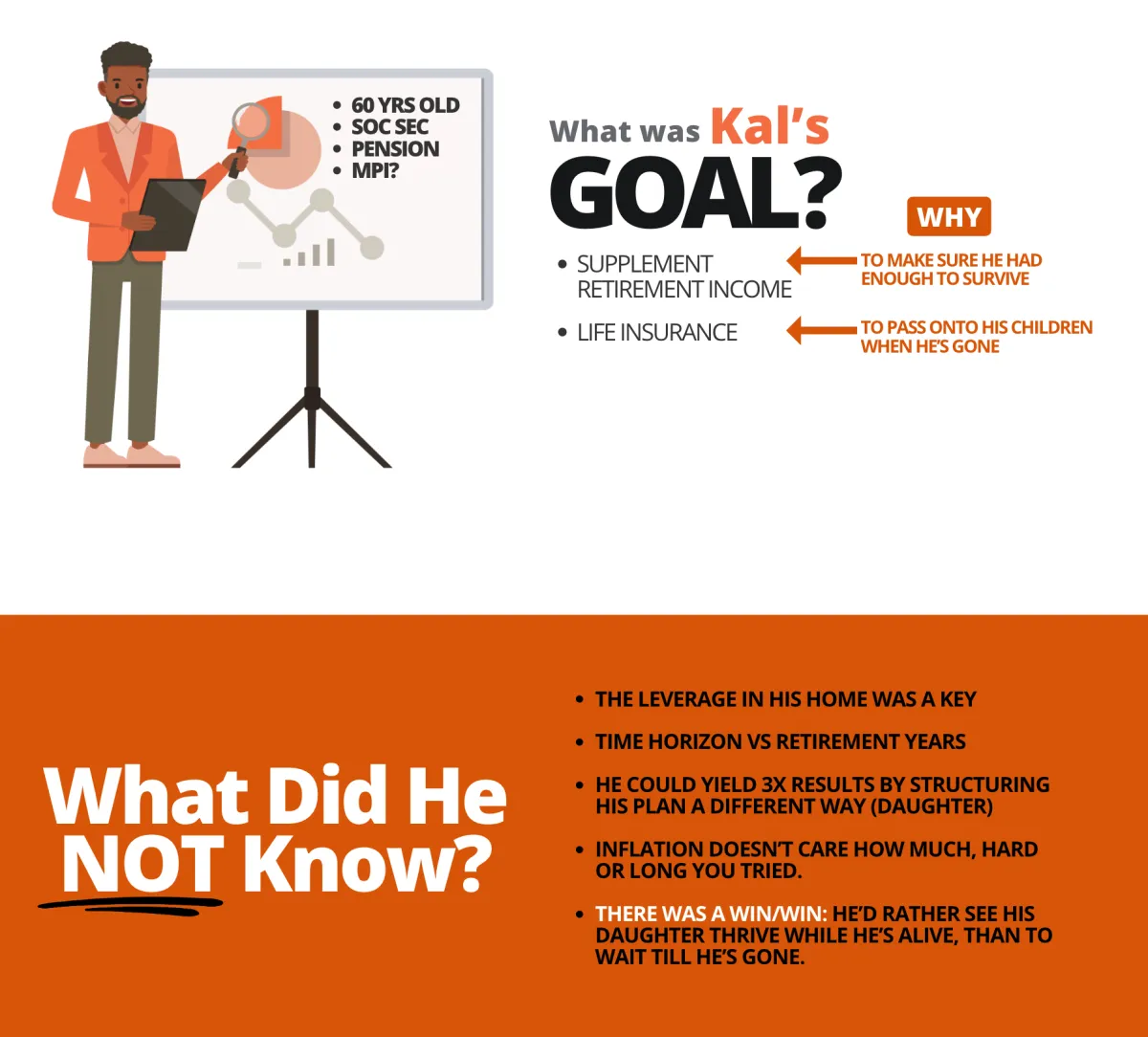

He teamed up with his daughter & used a HELOC to double his retirement income and secure a sizable "supplemental retirement income of

$104,000 of tax free income

and pass this same income to his daughter that she will be able to receive for life.

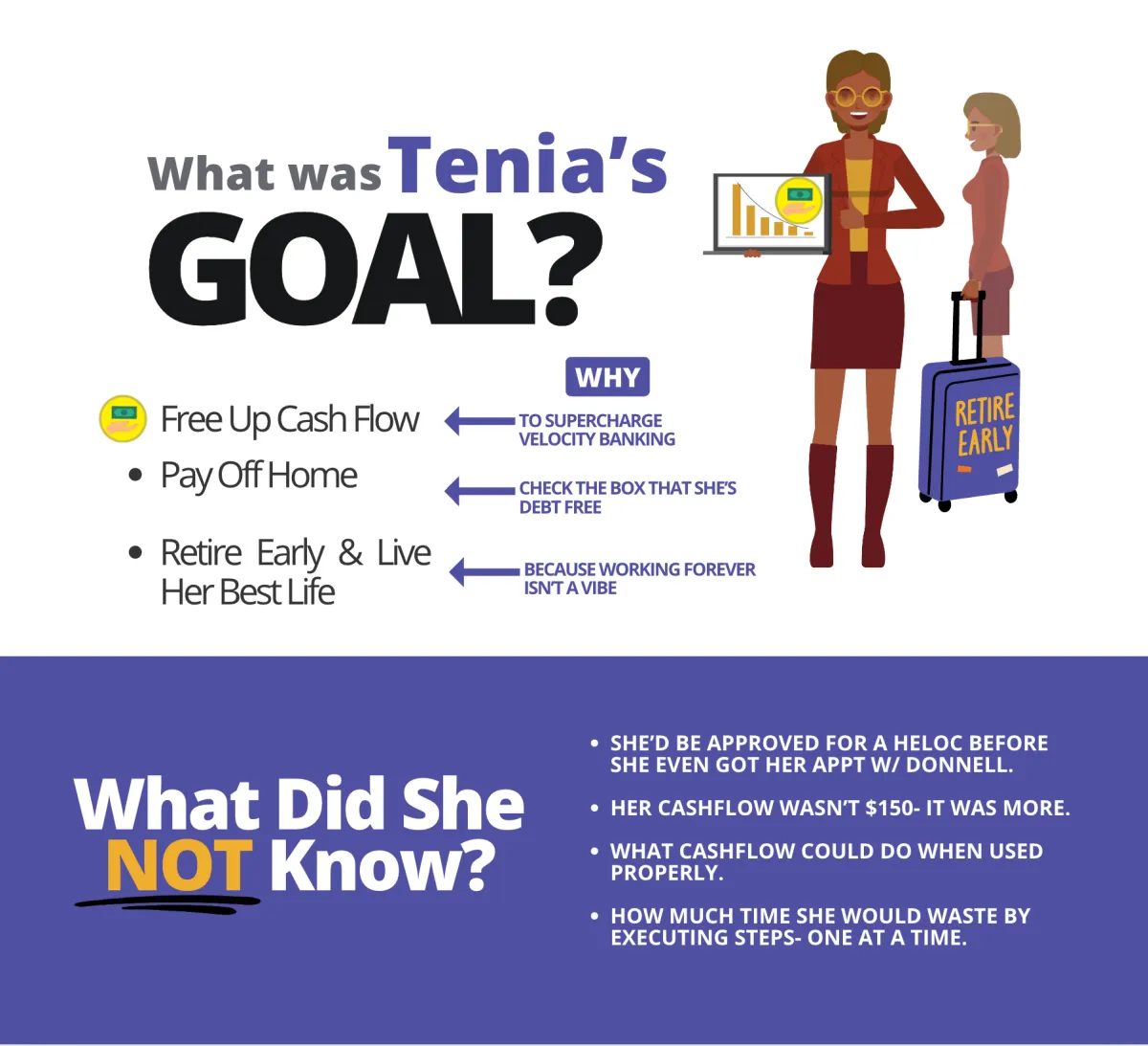

She had negative cash flow, but crushed

$36,000 in 16 months

and in addition, she will now have

$213,000 Annual Tax Free Income For Life

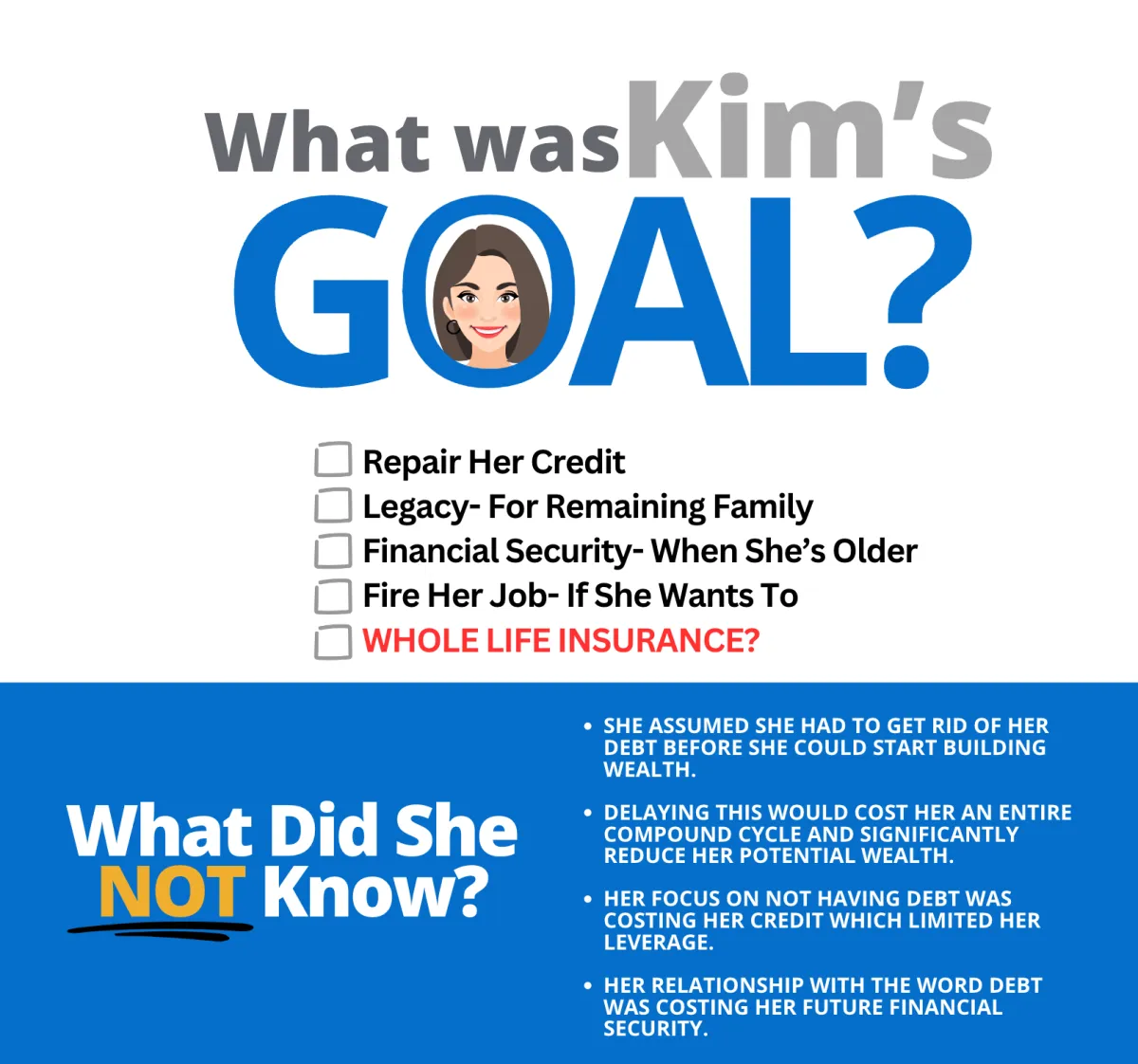

We helped her crush debt and build wealth.

$104,000 in 15 mos

Watch How She Crushed Debt in Part 1

Watch How She Built Tax Free Income in Part 2

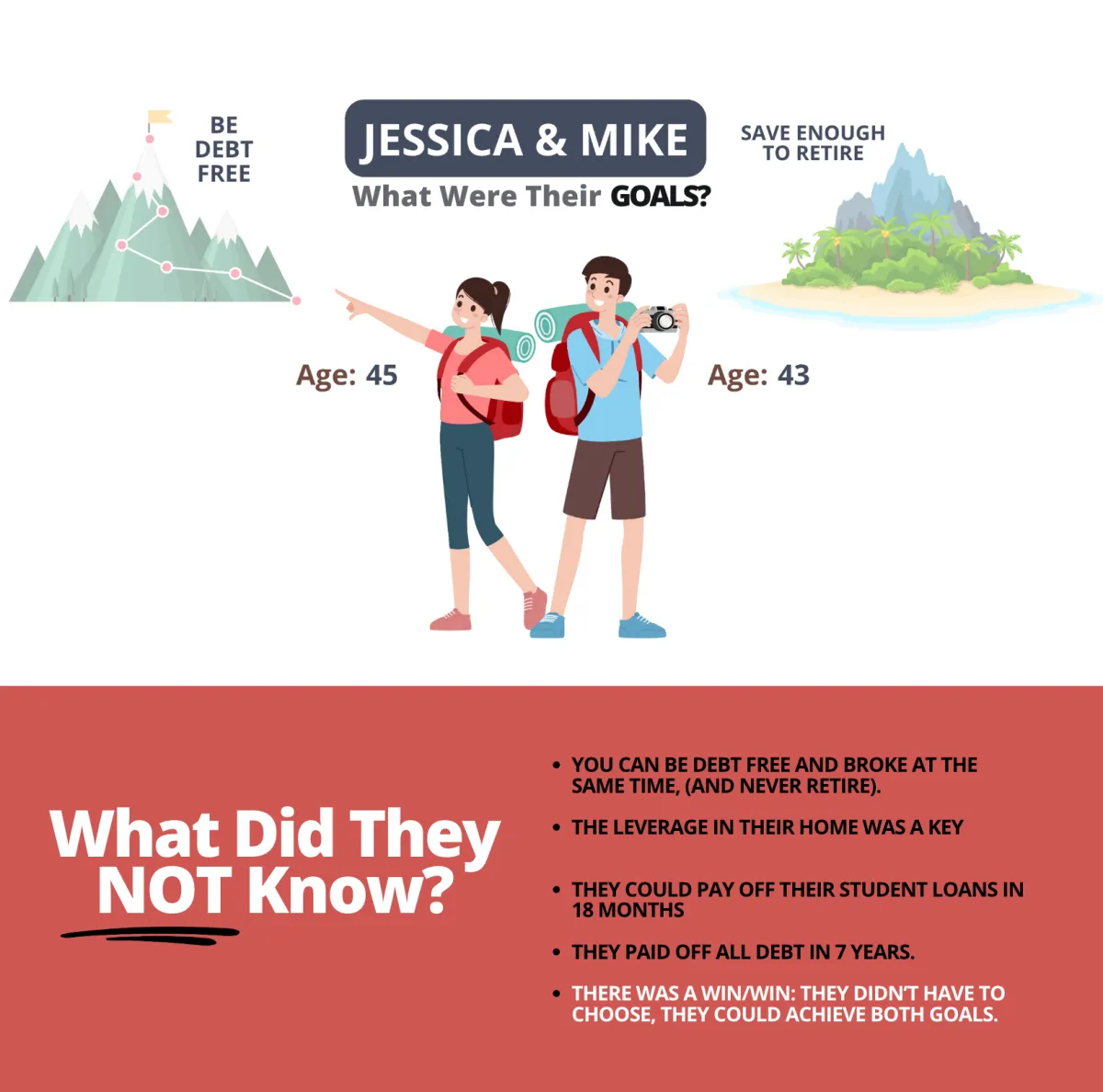

We helped them create a step by step plan to crush

$60,000 in Student Loans in 18 mos

+$300,000 Mortgage in 5.5 yrs

= $360,000 in just 7 years total

While also helping them build

$213,000 Annual Tax Free Income For Life

This couple DID NOT use velocity banking and still were able to eliminate

$10,000 debt in 2 months

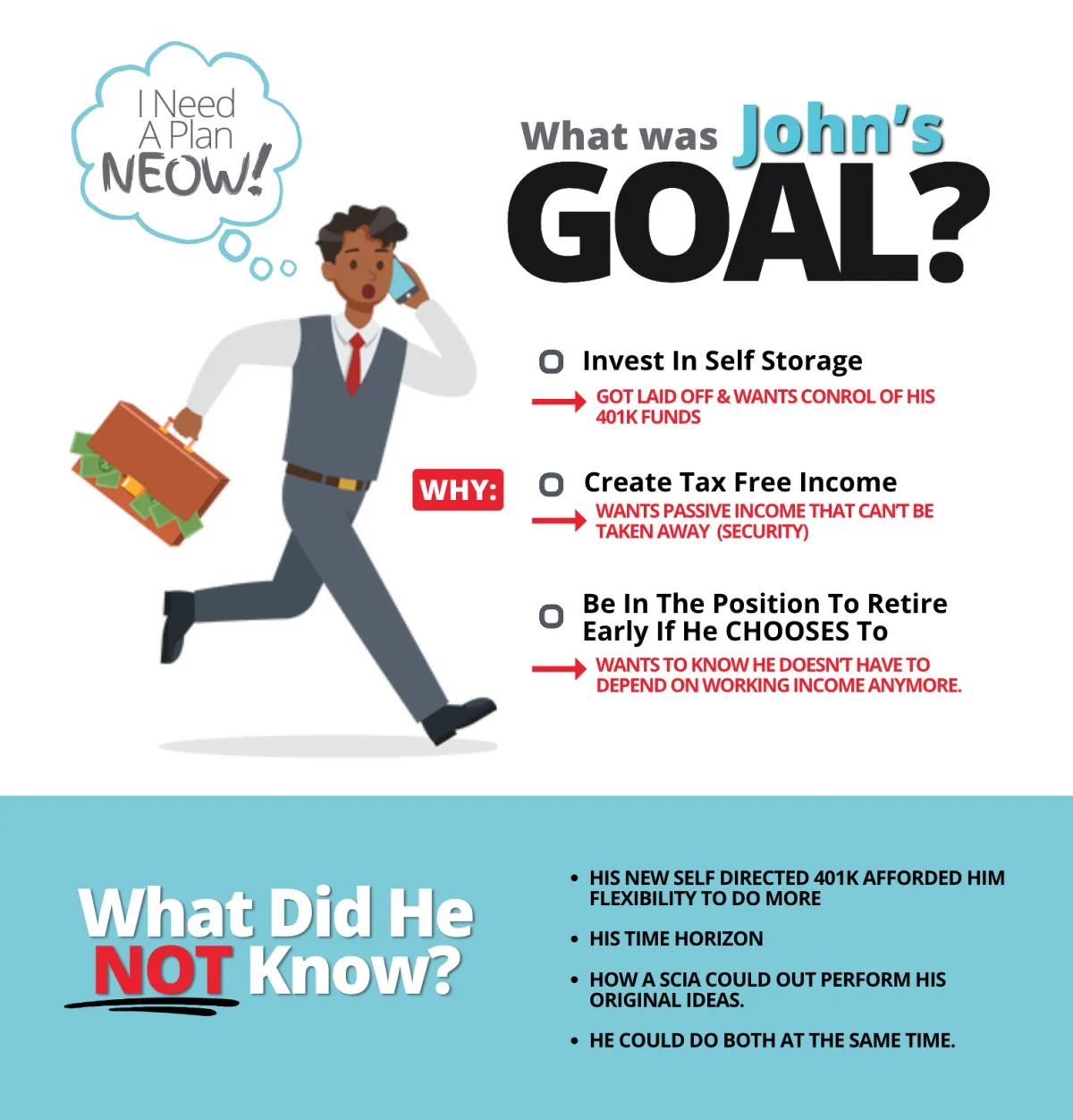

We helped him Turn A Layoff into Early Retirement and taught him a way to achieve his income goals in a fraction of the time and effort.

"Sarah"

We helped her create a step by step plan to crush

$272,000 in 17.3 mos

"John"

26 yrs old, was able to crush

$10,000 in 8 mos

"Alex"

Paid off His Car

$10,000 in 10 mos

""

Leveraged His SD 401k to crush

$40,000 in 12 mos

More 101 Videos That May Help

FAQ'S

What is Velocity Banking and how does it work?

Velocity Banking is a financial strategy that involves using a line of credit, such as a HELOC, to manage cash flow and pay off debts faster. It leverages your income to make multiple payments towards debts each month, reducing interest and accelerating debt payoff.

What should I do if my credit is impacted by multiple inquiries?

If your credit has been impacted by multiple inquiries, you can dispute those inquiries, especially if you did not receive any value from them. Consolidating inquiries related to the same purpose can also help mitigate the impact on your credit score.

What is the best strategy to manage negative cash flow until my cash inflow starts?

Focus on minimizing expenses and possibly using a debt snowball method to pay off smaller debts first. This can help free up some cash flow and make it easier to manage until the larger cash inflow begins.

How can I improve my cash flow while paying off debt?

You can improve your cash flow by reducing expenses, using a debt snowball method to pay off smaller debts first, and leveraging any lump sum payments or additional income to pay down high-interest debts.

How do I choose between different debt repayment strategies?

Choosing between debt repayment strategies depends on your financial situation. If you have positive cash flow, velocity banking might be effective. If you have negative cash flow, the debt snowball method, which focuses on paying off smaller debts first, may be more suitable.

What is the difference between debt snowball and velocity banking?

Debt snowball involves paying off smaller debts first to build momentum and free up cash flow. Velocity Banking uses a line of credit to pay down larger debts faster by making multiple payments each month. The best method depends on your cash flow situation.